http://www.dailyfx.com/forex/fundamental/article/drivers_of_price_action/2011/01/21/New_Zealand_Dollar_Could_Sink_Further_on_Declining_Yield_Expectations.html

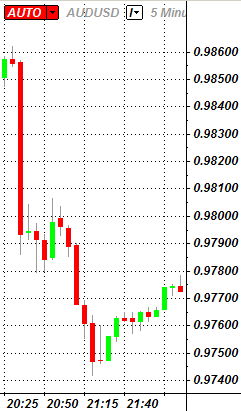

NZD/USD

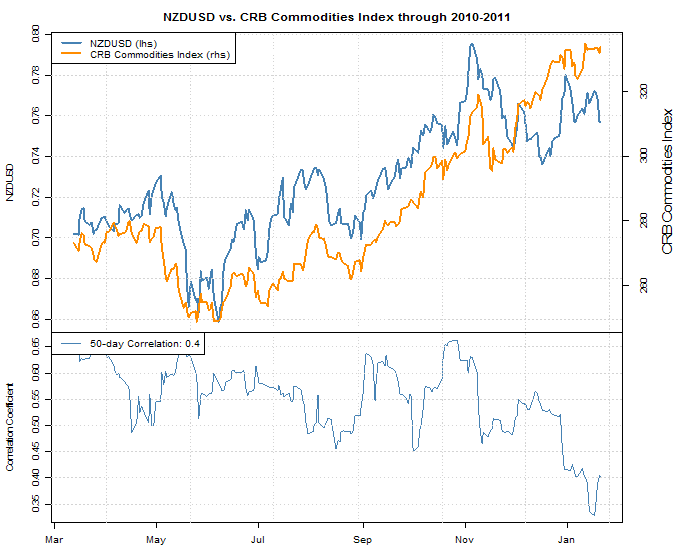

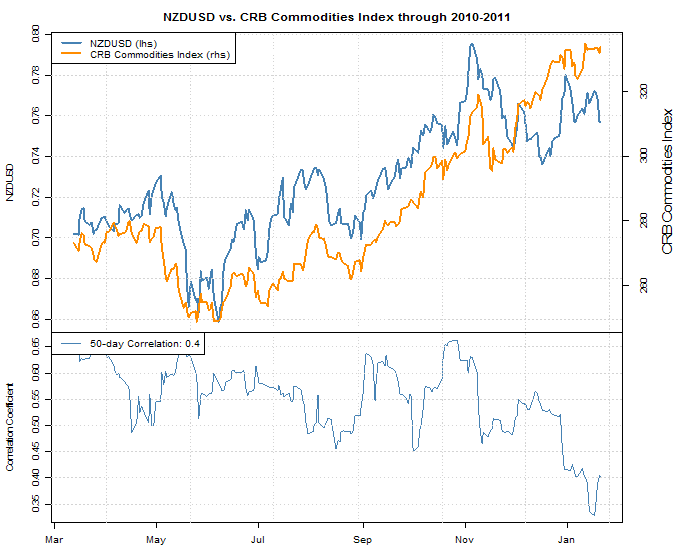

The outlook for the Kiwi took a hit following China’s GDP reading, as the 9.8% pace of growth exceeded expectations of 9.2% and fueled speculation for more tightening from the PBOC. The prospect of slower growth from the world’s second largest economy has dimmed the outlook for domestic growth for the export driven economy and lowered the prospect of further rate hikes from the RBNZ. Yield expectations continue to have an impact of NZD/USD, explaining 31% of direction. As a result commodity prices have started to lose the influence with recent movements showing a 40% correlation compared with 53% a month ago. However, costs for raw material have also been impacted by the potential for slower Chinese growth and has the pair re-coupling with broader trends. I expect risk trends to continue to have significant influence over the pair but domestic fundamentals are also potential drivers as we saw with the December retail sales figures.

| Driver of Price Action | Current Influence | Correlation | Week Ago | Month Ago |

| NZD Interest Rate Expectations | Medium | 0.31 | 0.26 | 0.35 |

| USD Interest Rate Expectations | Low | -0.02 | -0.03 | -0.19 |

| Commodities (RJ/CRB Index) | Medium | 0.40 | 0.33 | 0.53 |

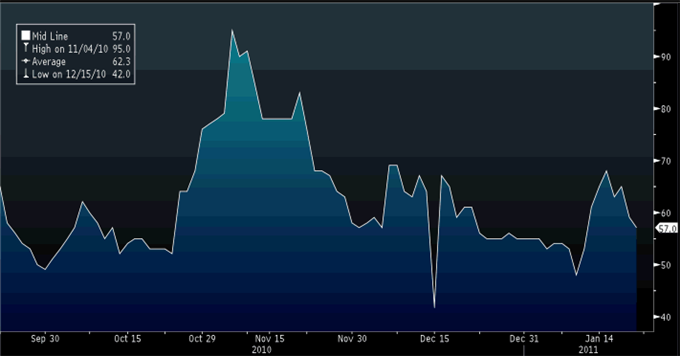

RBNZ Interest Rate Expectations

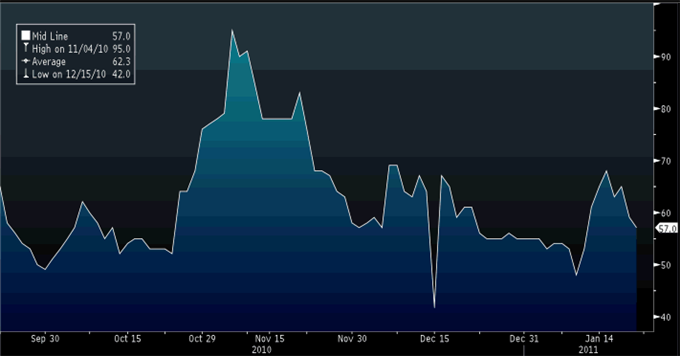

An unexpected 0.2% decline in core consumer demand combined with the outlook for Chinese monetary policy has RBNZ interest rate expectation on the decline. Overnight Index Swaps are now pricing in 57 bps of tightening over the next year significantly down from 95bps in November. Markets wee pricing in the future contribution to growth from earthquake rebuilding efforts. However, the natural disaster is expected to have a negative short-term impact on growth which would be amplified by slowing global demand for New Zealand exports. Policy makers will meet next week to determine future monetary policy with forecasts for the official cash rate to remain unchanged at 3.00%. A dovish outlook from Governor Bollard could drag the kiwi lower, but concerns over upside risks to inflation would potentially extend the current medium-term bullish trend. Discuss this and trading ideas join the NZD/USD forum.

Credit Suisse (OIS) RBNZ

Source Bloomberg – Prepared by John Rivera

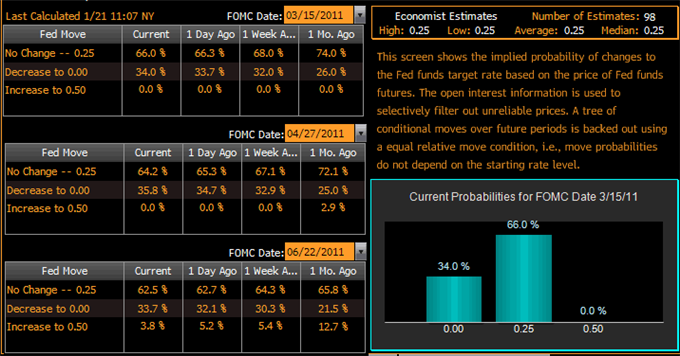

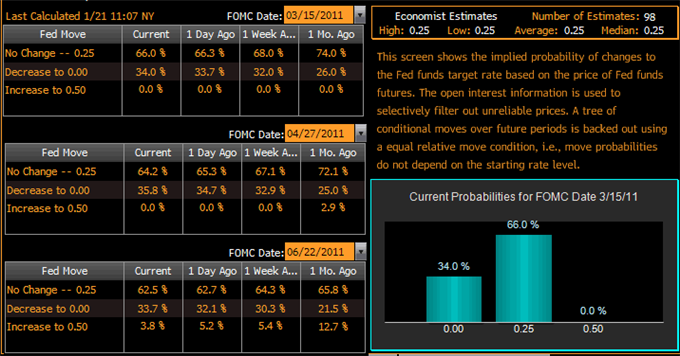

FOMC Interest Rate Expectations

Fed fund futures are now pricing in a mere 3.8% chance of a rate hike by June as yield expectations continue to dim with the U.S. recovery expected to be slow. However, a significant drop in initial jobless claims and 12.3% jump in existing home sales are signs that the labor and housing markets are making positive strides. Markets will need to see further confirmation before the outlook for interest rates brighten, but it could bring an end to prevailing pessimism. There will most likely be little change in yield expectations before the FOMC rate decision ahead on January 26th.

Source Bloomberg – Prepared by John Rivera

Commodities

Commodity prices are slightly higher on the day as they continue to reverse yesterday’s sell off as the prospect for Chinese tightening dimmed. Strong earnings from GE and a record high in German investor confidence helped set a bullish tone for the day which has benefitted prices for raw materials. A rising trend line on the RJ/CRB index has been supportive and could limit downside risks for prices and the kiwi. A potential wedge is developing which would warn of a breakout with risks tilted to the upside given the longer-term bullish trend. Discuss this and other fundamental data in the Economics Forum.

RJ/CRB Index (1 Day)

To discuss this report or be added to the email list contact John Rivera, Currency Analyst: jrivera@fxcm.com

DailyFX provides forex news on the economic reports and political events that influence the currency market.

Learn currency trading with a free practice account and charts from FXCM.

Learn currency trading with a free practice account and charts from FXCM.