http://www.dailyfx.com/forex/fundamental/article/weekly_strategy_outlook/2010/12/27/Forex_Strategy_Outlook.html

Market Conditions Summary

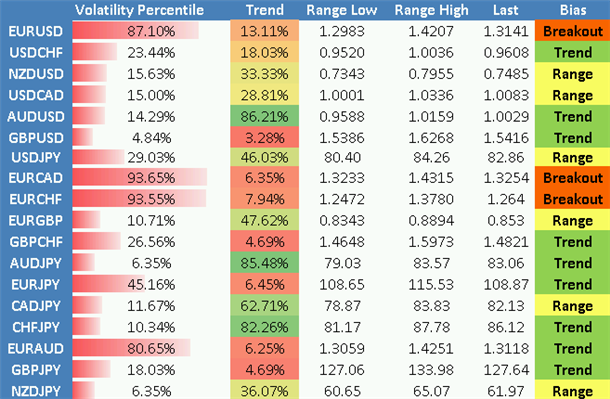

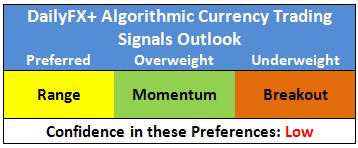

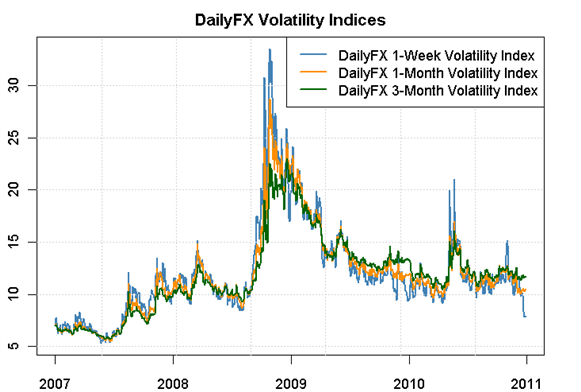

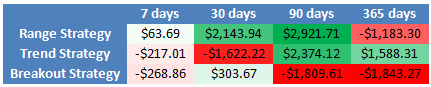

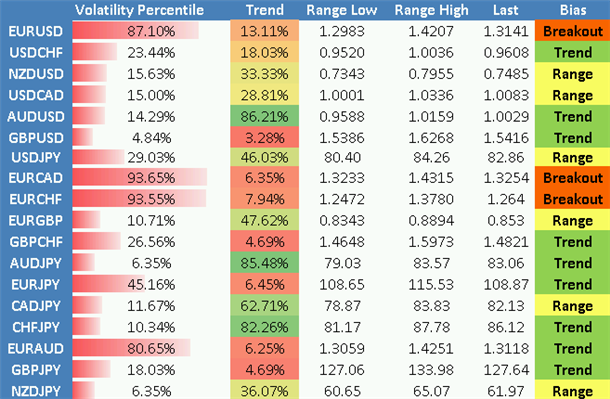

Forex options markets volatility expectations have fallen to their lowest levels in the past three years, pointing to few important swings across major currencies. Our benchmark range trading Relative Strength Index system has generally performed well through recent trade, while our volatility-friendly Channel Breakout system has seen poor performance through the same stretch. Forex Options markets volatility expectations show that traders are betting on and hedging against slower currency moves into the week ahead, and we will accordingly position ourselves for low-volatility systems heading into year-end trading.

|

Forex Trading Automated Systems Outlook

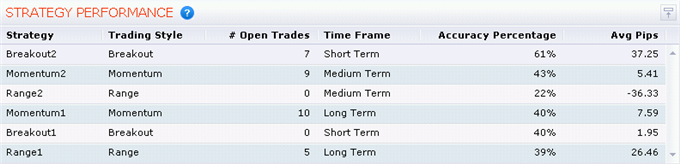

DailyFX+ System Trading Signals– Our momentum and breakout-based trading signals have seen surprisingly strong performance through the past week of trade, while the relative lack of trades in range-based systems have left performance roughly unchanged through the same stretch. Momentum2 and Breakout2 went heavily long the Japanese Yen and benefited from its subsequent appreciation. We admittedly did not anticipate major moves in JPY pairs, and it is difficult to predict that we will see extension in the week ahead. As such, we remain weighted towards Range systems until further notice.

|

To gain a greater understanding of all six trading systems, view my recent presentation on SSI and the trading signals on our FXCM Digital Expo page.

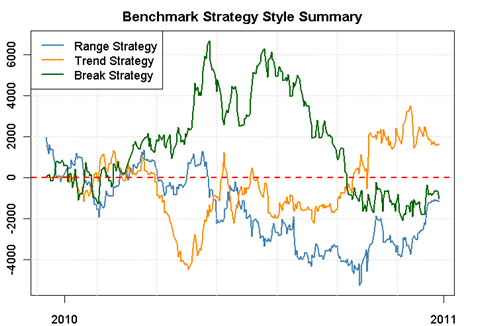

Benchmark Trading Systems

|

Data and Backtest Results Generated using FXCM Strategy Trader

Effectively sideways price action in most currency pairs made for similarly uneventful moves in our benchmark trading strategies, and similarly low volatility expectations point to range-bound moves in the days ahead. If anything, we remain weighted towards range-friendly Relative Strength Index (RSI) strategy trading in the week ahead. Yet illiquid market conditions warn against taking large bets and we advise traders to use caution until the New Year.

DailyFX Individual Currency Pair Conditions Summary

Written by David Rodríguez, Quantitative Strategist for DailyFX.com, drodriguez@dailyfx.com

To be added to this author’s distribution list, send an e-mail subject line “Distribution list” to drodriguez@dailyfx.com

Definitions

Range Strategy – The benchmark range trading system shows the hypothetical performance of a simple Relative Strength Index strategy on 60-minute EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, and NZDUSD pairs. It sells when the 14-period RSI falls below 70 and buys when it crosses above 30. No other trading rules are used. Hypothetical results are generated using FXCM Strategy Trader

Trend Strategy– The benchmark trend trading system shows the hypothetical performance of a simple Moving Average Crossover strategy on 60-minute EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, and NZDUSD pairs. It buys the currency pair when the 50-period Simple Moving Average crosses above the 100-period and 200-period averages. It sells when the 50-period crosses below the 100-period and 200-period averages. No other trading rules are used.

Breakout Strategy– The benchmark breakout trading system shows the hypothetical performance of a simple Channel Breakout strategy on 60-minute EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, and NZDUSD pairs. It will set a buy order at the highest high of the previous 20 bars plus one pip and a sell order at the lowest low of the previous 20 bars minus one pip. No other trading rules are used.

Volatility Percentile– The higher the number, the more likely we are to see strong movements in price. This number tells us where current implied volatility levels stand in relation to the past 90 days of trading. We have found that implied volatilities tend to remain very high or very low for extended periods of time. As such, it is helpful to know where the current implied volatility level stands in relation to its medium-term range.

Trend– This indicator measures trend intensity by telling us where price stands in relation to its 90 trading-day range. A very low number tells us that price is currently at or near monthly lows, while a higher number tells us that we are near the highs. A value at or near 50 percent tells us that we are at the middle of the currency pair’s monthlyrange.

Range High– 90-day closing high.

Range Low– 90-day closing low.

Last– Current market price.

Bias– Based on the above criteria, we assign the more likely profitable strategy for any given currency pair. A highly volatile currency pair (Volatility Percentile very high) suggests that we should look to use Breakout strategies. More moderate volatility levels and strong Trend values make Momentum trades more attractive, while the lowest Vol Percentile and Trend indicator figures make Range Trading the more attractive strategy.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES IS MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION.

OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. The FXCM group will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance contained in the trading signals, or in any accompanying chart analyses.

DailyFX provides forex news on the economic reports and political events that influence the currency market.

Learn currency trading with a free practice account and charts from FXCM.

Learn currency trading with a free practice account and charts from FXCM.

No comments:

Post a Comment