http://www.dailyfx.com/forex/fundamental/forecast/weekly/eur/2011/01/01/Euros_Financial_Survival_may_be_a_Serious_Question_in_2011.html

Euro’s Financial Survival may be a Serious Question in 2011

Fundamental Forecast for Euro: Bearish

Price action can be misleading if you are simply looking for a reflection of a currency’s (and thereby the economy and market it represents) health via its relative level on the market. If we were working with a ‘pure’ or ‘efficient’ market, then the shared currency would seem to have steadied and even improved somewhat through the final two weeks of the trading year. However, we as traders know better. The speculative influence and capital flows behind these markets materially distorts the basic fundamental perspective of a currency (just look at the strength of the Japanese yen given the multi-decade deflation, credit and economic problems it is still facing). This is exactly the case for the euro through the final breaths of 2010. Thinned-out markets and necessary position changes seemed to put a bullish face on the otherwise pained currency. Heading into the new trading year, however, it is important that we not be lulled into passively accepting what policy makers or short-term speculative swings would lead us to believe. The market’s prevailing sense of ‘fair value’ for the euro is always correct; but objective fundamentals act as an anchor through the volatile swings. Eventually, the two are reconciled – and it is rarely the underlying and slow-to-develop fundamentals that make the change.

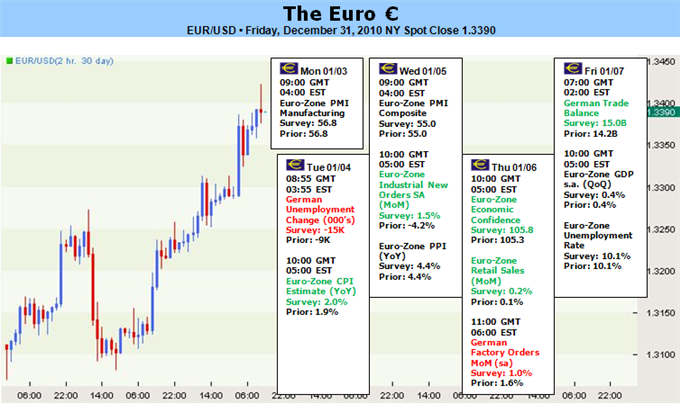

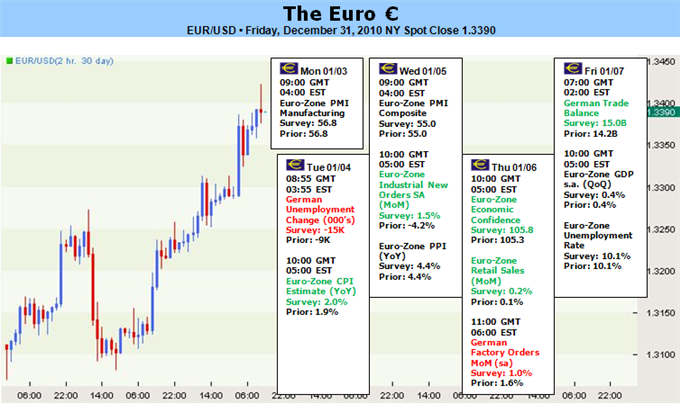

Though the fundamental forecast for the euro is bullish; this is more accurately an assessment for the month and perhaps the quarter. For the week ahead, we will still have to deal with the distortions of turnover associated with ending one trading year and moving on to the next. Half of the industrialized world’s banks will still be offline Monday; and more importantly, it will take a little time for funds, banks, central banks and speculators to establish their positioning for the New Year. There is a good chance that a meaningful trend can develop through some of the more significant underlying trends (the EU’s financial crisis, growth concerns, general risk appetite, etc); but in the absence of a definitive move, it will be worthwhile to keep track of short-tem volatility on scheduled event risk. It isn’t difficult to identify the importance of all the economic releases on the docket; but a few will certainly stand out. The first notable is German employment data. As the region’s power source, the German consumer will have to saddle a lot more of the region’s burden to lift the entire EU out of its troubles. The same day, the Euro Zone CPI figures are expected to put interest rate concerns back on the board. A 2.0 percent reading would put the reading at the ECB’s target; but pushing for rate hikes when many EU members can’t access the debt market would be exceptionally dangerous. Finally, the range of sentiment surveys should give a well-rounded assessment of what is expected from the most important aspects of the region’s health.

If we really want to get a sense of the euro’s future, we need to look beyond the data updates and liquidity issues. The European Union’s financial health has deteriorated significantly in the past weeks and months; and against the backdrop of relatively stable prices, the euro hasn’t nearly accounted for the added concern. Among the few developments threaten bigger problems, we have further sovereign debt downgrades, consumer deposit withdrawals, necessary debt raising (Spain and Italy require an estimated 400 billion euros worth through the spring and the ECB is tentatively having problems with sterilizing its stimulus effort. What is the real stimulus picture of Europe? It is generally accepted that the region is doing much better than the US, UK or Japan; but it is in fact in the same boat. What’s more, the imbalance in health between the major members and considerable pain some will have to suffer between recession and austerity could necessity a far more expansive welfare effort or a change in the group’s structure (perhaps raising acceptable debt levels). At this pace, more members may succumb to crises and stimulus is likely to run out before everyone has found their footing. – JK

DailyFX provides forex news on the economic reports and political events that influence the currency market.

Learn currency trading with a free practice account and charts from FXCM.

Learn currency trading with a free practice account and charts from FXCM.

No comments:

Post a Comment